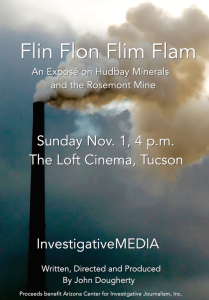

4 p.m., Sunday, Nov. 1

The Loft Cinema

3233 E Speedway Blvd, Tucson, AZ 85716

$10 (benefits Arizona Center for Investigative Journalism, Inc., a nonprofit 501-c3)

………………………………………….

InvestigativeMEDIA turns its unflinching focus on Canadian miner Hudbay Minerals Inc. and its controversial plans to construct the massive Rosemont open-pit copper mine in the Santa Rita Mountains on the Coronado National Forest southeast of Tucson.

InvestigativeMEDIA’s John Dougherty documents Hudbay’s legacy of lead poisoning in a remote Manitoba community where the company operated a notorious copper smelter for 80 years.

He then turns to Hudbay’s former operations in Guatemala where the company stands accused of murder, rape and shootings in a precedent setting civil trial.

Dougherty travels to the Peruvian Andes documenting indigenous villagers occupying a mine site after Peruvian police beat and teargased protestors angry over Hudbay’s failure to abide by an agreement.

Dougherty uncovers Hudbay’s misleading statements over its proposed Rosemont copper project and the ecological treasure that would be destroyed if the mine were constructed. (Dir. by John Dougherty, 2015, in English/Spanish/English subtitles, 51 mins.)